We want to update you on the steps we are taking to ensure we can continue to meet your legal needs in a secure and reliable manner. This year marks our firm’s 20th year in Navarre, and our team remains fully operational and here to support you and our community...

3 Florida Estate Planning Documents You Need Right Now

Although you can’t always protect yourself from the unexpected, you can (and should) clarify what you would like to have happened when it does. Three, fairly simple estate planning tools is all you need. These documents include:

- A Will

- A power of attorney; and

- An advance directive for health care

While each is important in its own respect, they bring you and your family the most peace of mind when you have all three in place together. Here is why:

With these three documents in place, you will essentially be answering the following very important questions:

- Who will inherit your estate?

- Who will administer your estate?; and

- Who will take care of your children, both day-to-day and if you pass away before they reach adulthood?

Last Will and Testaments

To put it briefly, your Will addresses what you want to have done with your estate when you die? Among other things, having a Will in place allows you to do the following:

- Name someone who will be in charge of disposing of your estate.

- Name someone who will look after your minor children.

- State how your assets are to be distributed to your heirs.

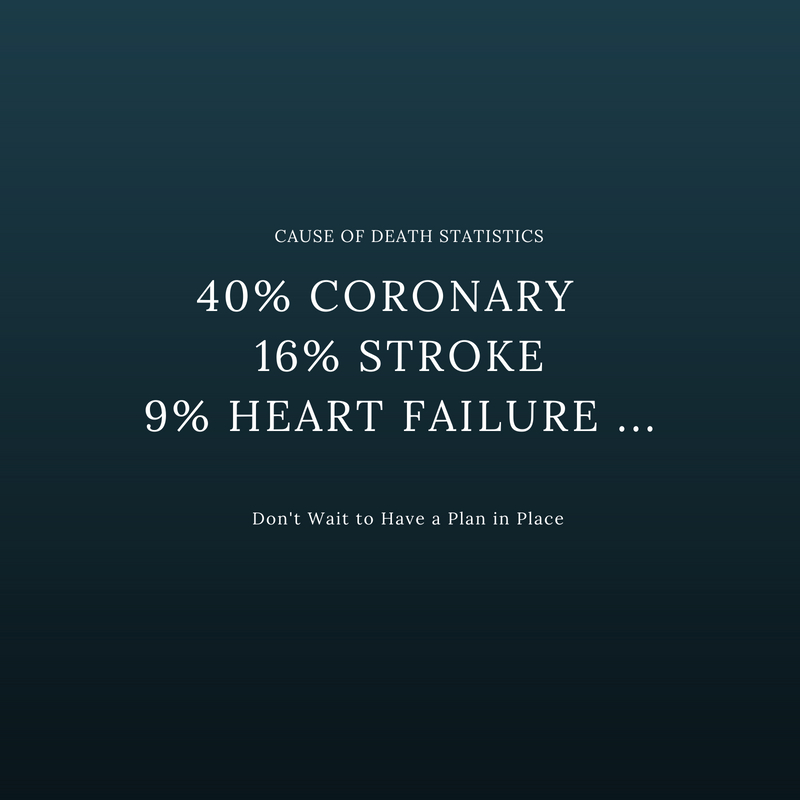

These are certainly important estate planning goals to accomplish, especially if you will be leaving behind minor children. However, there are other situations that, though they may not result in your death, can render you temporarily unable to care for yourself or your loved ones.

When you become incapacitated or otherwise unable to care for yourself and your loved ones, for any length of time, a Will won’t help you. Furthermore, you may not want other people making important decisions for you when you could have made them in advance yourself.

This is why you also need the other two documents in place. Unlike your Will (which only becomes effective when you die), your power of attorney and your advance directive for health are effective when you are alive.

Durable Power of Attorney

A power of attorney is the estate planning tool you use if you need someone to handle your financial affairs when you are unable to do so yourself. A power of attorney may be defined narrowly— such as when granting someone (your attorney-in-fact) access to your bank account in order to pay bills for you for a limited period time.

On the other hand, your power of attorney can grant broad power, like when you give someone full access to your financial accounts in order to manage all of your assets indefinitely, or until you revoke the power of attorney or it expires.

For example, you may need a power of attorney if you want to buy a house, but you’re traveling or out of the country or you’re stuck in the hospital nursing an injury. In this case, your attorney-in-fact (often your spouse or someone you implicitly trust) can execute the transaction for you.

Advance Health Care Directive or

Designated Health Care Surrogate

With a Florida advance health care directive, which can include a living Will, you can select one or more individuals to look after your assets and to make medical decisions on your behalf if you become incapacitated, temporarily or indefinitely. So, essentially, when you become incapacitated and unable to make your own decisions, your power of attorney loses its validity and your advance health care directive takes over.

Ideally, you won’t need your advance health care directive, but consider how it will be if you end up needing someone to make medical decisions for you, but you never took the time to write down in advance your wishes with regard to medical care. This will not only make it less likely that your wishes will be fulfilled, but will also leave your loved ones with some very difficult decisions to make. Planning in advance can prevent both these things from happening.

Contact An Experienced

Florida Estate Planning Attorney

For more information regarding estate planning in Florida, consult with a qualified and experienced estate planning attorney. Contact Lynchard & Seely, PLLC, either online or by calling 1-850-936-9385, to arrange a consultation with one of our expert Florida estate planning attorney.

Want Help With Your Estate Plan?

Click Below to Schedule a FREE Initial Consultation!

Lynchard & Seely – COVID-19 Update

3 Florida Estate Planning Documents You Need Right Now

Three, fairly simple Florida estate planning documents is all you need. While, other things can help more, these will get you by in a pinch.

Estate Planning For Small Business Owners

Estate Planning for Small Business Owners – You have to think about more when estate planning if you have a business.

Want Help With Your Estate Plan?

Click Below to Schedule a FREE Initial Consultation!