We want to update you on the steps we are taking to ensure we can continue to meet your legal needs in a secure and reliable manner. This year marks our firm’s 20th year in Navarre, and our team remains fully operational and here to support you and our community...

Living Trust – What is it?

A living trust (also referred to as a revocable living trust) is a written agreement created for the simple purpose of holding ownership of assets outside of your probatable estate during your lifetime, and then distributing these assets to named beneficiaries after your death.

Specifically, you as the creator of the living trust (known as the “settlor”) transfer property from your personal ownership to a trust that you have created. You then name yourself as the initial trustee of that trust.

The result is that while legal ownership of the trust property changes from you to the trust, you (as initial trustee) continue to maintain control over your property and can continue to enjoy it in the same way as you did prior to transferring it to the trust. When you die, a person appointed by you and known as a “successor trustee” steps in, takes control of the trust, and transfers the trust assets to the people named as beneficiaries under the trust agreement.

Living trusts are revocable, meaning that you as the grantor reserve the right to revoke or terminate the trust and resume personal ownership of the trust property at any time. In addition, you maintain discretionary rights to add to or withdraw assets from the trust property, to change the terms of the trust, and even to make it irrevocable at some time in the future.

Advantages of Living Trusts

There are a number of advantages to using living trusts, including but not limited to:

- A living trust allows assets to avoid probate – After you create a living trust, you must fund it by transferring title to certain assets from your name to the name of the trust. For example, from Bob Smith to Bob Smith’s trust. Assets owned by the trust may skip probate and be transferred directly to your heirs after your death. This will facilitate a faster transfer and allow your heirs to begin managing those assets sooner. You will also be saving your heirs a considerable amount of money in court costs and legal fees.

- Privacy – Probate is a public process and your assets and everything associated with them will be a part of the public record. On the other hand, a living trust is a private contract between the grantor and the trustee. As such, there is no public filing requirement and the terms of the trust, its assets, and beneficiaries can remain confidential.

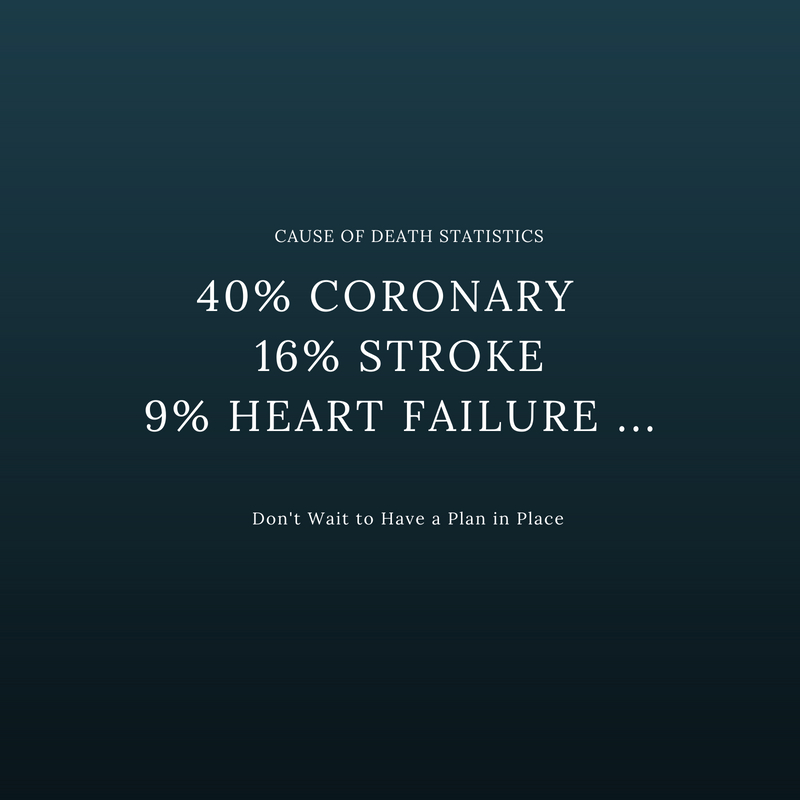

- A living trust helps you plan for incapacity – When you create a living trust you can name a successor trustee, who will take over the management of the trust assets if you are unable to continue as trustee dues to incapacity. This allows you to ensure that a person designated by you will protect and manage the trust assets if something were to happen to you.

- Flexibility – There is a lot you can do with a living trust to achieve your estate planning goals. Furthermore, you can change the trustee and beneficiaries of a living trust, add or withdraw assets, modify the terms, or revoke a living trust whenever you want.

Disadvantages of Living Trusts

There are a number of disadvantages to using living trusts. These include the following:

- Potential for failure to properly fund the living trust – One of the biggest problems associated with living trusts is the failure to properly transfer assets into the trust. When assets are not properly transferred to the trust, they remain part of your probatable estate and are not subject to the terms of your trust.

- Lack of court supervision – One of the benefits of the probate system is that the court often watches over the distribution of your estate, and in doing so protects the interests of your beneficiaries. However, no such supervision occurs with a living trust as the responsibility for effecting and overseeing the distribution of your trust assets rests solely with your designated successor trustee. This can be disadvantageous in certain circumstances.

- Limited financial savings for smaller estates – The real determination as to whether a living trust will save you money depends on the amount of probate fees that would have been paid had the trust assets gone through probate, rather than passing through your living trust. If the estate has a small monetary value, you may find that the probate fees are quite low in relation to the costs of establishing and maintaining a living trust.

- Limited asset protection – A living trust does not provide the same level of asset protection as some other estate planning tools (i.e. irrevocable trusts). The assets in the trust can still count for the purpose of determining if you qualify for Medicaid to cover nursing home care. Furthermore, a living trust won’t shield your assets from being counted for estate tax purposes.

Do I Need A Living Trust?

Not everyone needs a living trust. As a general rule of thumb, you might not need a living trust if you are young and healthy, can more easily transfer your assets (or some of them) by other probate avoidance methods, or when you do not own any (or very little) property of value. You should consider your own situation carefully before making any decision to create a living trust.

An experienced estate planning attorney can help you to determine if a living trust is the best option for you. For more information about living trusts in Florida, contact the Florida estate planning attorneys at Lynchard & Seely, Pllc at 1-850-936-9385 or visit our contact page to book an appointment.

Want Help With Your Estate Plan?

Click Below to Schedule a FREE Initial Consultation!

Lynchard & Seely – COVID-19 Update

3 Florida Estate Planning Documents You Need Right Now

Three, fairly simple Florida estate planning documents is all you need. While, other things can help more, these will get you by in a pinch.

Estate Planning For Small Business Owners

Estate Planning for Small Business Owners – You have to think about more when estate planning if you have a business.

Want Help With Your Estate Plan?

Click Below to Schedule a FREE Initial Consultation!